2024 AGM – Results

Notice of AGM

The Group has made significant strategic progress within the year with a full business review completed in 2023. Whilst the strength of our two core brands, SiS and PhD, is unquestionable, the relentless pursuit of top line growth led to some poor historic strategic decisions and an inflated operating structure.

To date, a number of actions have been taken, benefitting the final quarter of 2023 and providing a stable platform for 2024 in order for the business to reset.

As part of the comprehensive review of the business in FY23, the leadership team have outlined six key areas of focus, which will enable the Group to reset in FY24 and deliver long-term value going forward;

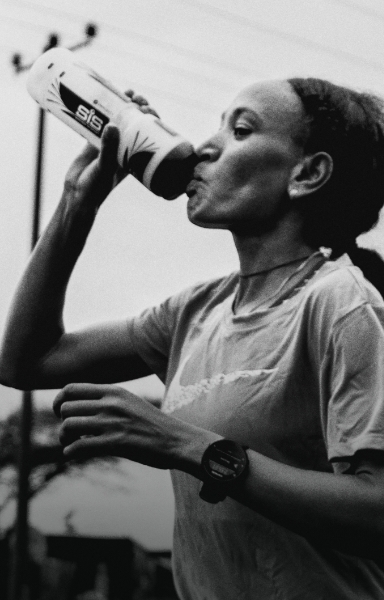

As a world leader in nutritional science and product development, investment in science remains at the core of the business. Quality, efficacy of ingredients and proven product benefits are key principles of both brands.

Both brands command significant share within their respective markets. Science in Sport holds the number one position in UK retail and marketplace channels, with a leading presence globally. PhD is in the top three within the UK retail and marketplace channels and is strongly positioned in the Asia Pacific region. We will continue to grow brand awareness, leveraging our Elite athlete portfolio and scientific credentials, through targeted investment delivering measurable returns.

The opportunity for global sales growth is significant, given the strength of the brands and continued positive trajectory of the sports nutrition market. We will deliver this by working with existing and new partners, building profitable long-term relationships in the UK and globally.

The Group had previously pursued an aggressive growth strategy, while this delivered positive revenue growth it was not cash accretive. The revised strategy is on sustainable profitable cash generation, through delivery of enhanced margins on a lower cost base while deleveraging the business.

With the transition to the manufacturing facility at Blackburn fully completed, optimising the supply chain and manufacturing processes to deliver enhanced margins is the key focus for FY24.

We are resetting the culture and ways of working, our team are our biggest point of difference and we are creating the conditions where everyone can perform at their best.

The global sports nutrition market was worth $24.6bn in 2022 and is forecast to grow at 5.9% CAGR from 2022 to 2027. Our FY23 revenue of £62.8m represents a small share of this market, which highlights the scale of the opportunity for both brands.

Our current revenues are weighted to the UK, representing 56% of our total revenue and we have a market share of c4.5%. This is driven through strong distribution through multiple channels of specialist retailers, grocery, Amazon and our own direct channel. The UK is a key market and we see further opportunities to expand and grow our market share through existing and new customers.

Outside of the UK, representing 44% of our revenue, we have several key distribution partners covering multiple geographies. We are in the process of resetting a number of these commercial relationships to ensure strategic alignment, with the objective of delivering mutually beneficial profitable growth and improved margins.

We are committed to promoting sustainability and responsible business practices both as a Group and through our individual brands. As an industry leader, we have invested in packaging technology and plant to transition all protein powder products into recyclable pouch packaging, a first for the sports nutrition industry globally. Furthermore, our move to a new combined supply chain site in the prior year has seen significant environmental improvements by reducing transport miles, carbon emissions and creating new opportunities for those living and working in Blackburn.

Moving forward, we are taking a balanced view on prospects for 2024. Key strategic areas of focus include embedding the new operating model post the recent restructuring; controlled growth over the medium term; and continued margin improvements resulting in cash generation and deleveraging. As a result, whilst we anticipate year on year revenues will reduce, we are targeting a doubling of underlying EBITDA and reduction of the Group’s net debt.

Underlying the Group’s new operating model, and at the core of the business, are two very strong brands operating in an expanding marketplace. With confidence in the revised operating model, the new leadership team are taking the opportunity to re-engage with our core customers, shareholders and financing partners to build the business from a more stable platform and ultimately deliver substantial shareholder value.

Science in Sport PLC is traded under symbol SIS on the London Stock Exchange (LSE) Alternative Investment Market (AIM).

The Company’s issued share capital consists of 182,272,607 ordinary shares with a nominal value of 10p each, each share having equal voting rights. The Company does not hold any Ordinary Shares in treasury.

An Employee Benefit Trust holds 2,709,126 Ordinary Shares. The Employee Benefit Trust abstains from voting.

Notice of AGM

Notice of AGM

Proxy form for use at the General Meeting

Placing and Retail Offer & Notice of General Meeting

| Exchange | London Stock Exchange |

| Market | AIM |

| TIDM | SIS |

| ISIN number | GB00BBPV5329 |

| SEDOL number | BBPV532 |

| Company name | Science in Sport plc |

| Registered office | 16-18 Hatton Garden, London, EC1N 8AT, United Kingdom |

| Year end | 31st December |

| AGM | TBC |

| Registrars | Equiniti Limited, Aspect House, Spencer Road, Lancing, West Sussex, BN99 6DA |

| Nominated Advisor and Broker | Panmure Liberum, Level 12, 25 Ropemaker Street, London EC2Y 9LY |

| Solicitors | Addleshaw Goddard, Milton Gate, 60 Chiswell Street, London, EC1Y 4AG |

| Auditors | RSM LLP 14Th Floor Unity Building 20 Chapel St, Liverpool L3 9AG |

| Company Secretary | Daniel Lampard |

This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

Strictly Necessary Cookie should be enabled at all times so that we can save your preferences for cookie settings.

If you disable this cookie, we will not be able to save your preferences. This means that every time you visit this website you will need to enable or disable cookies again.